Home Mortgage Tips That Can Aid You Out

Article by-Mercado BowlesMillions of people want to own a home. When one becomes a homeowner, there is a huge feeling of pride and accomplishment involved. https://saratogatodaynewspaper.com/today-in-saratoga/business/item/14779-community-bank-n-a-opens-business-banking-center need a mortgage to help them purchase their home. There are several key facts to learn before getting a loan, and this article can be a great help.

Watch out for banks offering a "no cost" mortgage loan. There is really no such thing as "no cost". The closing costs with "no cost" mortgages is rolled into the mortgage loan instead of being due upfront. This means that you will be paying interest on the closing costs.

Have all financial documentation organized before applying for a loan. If you do not have the necessary paperwork, the lender cannot get started. This paperwork includes W2s, paycheck stubs and bank statements. The lender wants to see all this material, so keep it nearby.

Get pre-approved for a home mortgage before shopping for a new house. Nothing is worse than finding the perfect house, only to find out that you can't get approved for a mortgage. By getting pre-approved, you know exactly how much you can afford. Additionally, your offer will be more attractive to a seller.

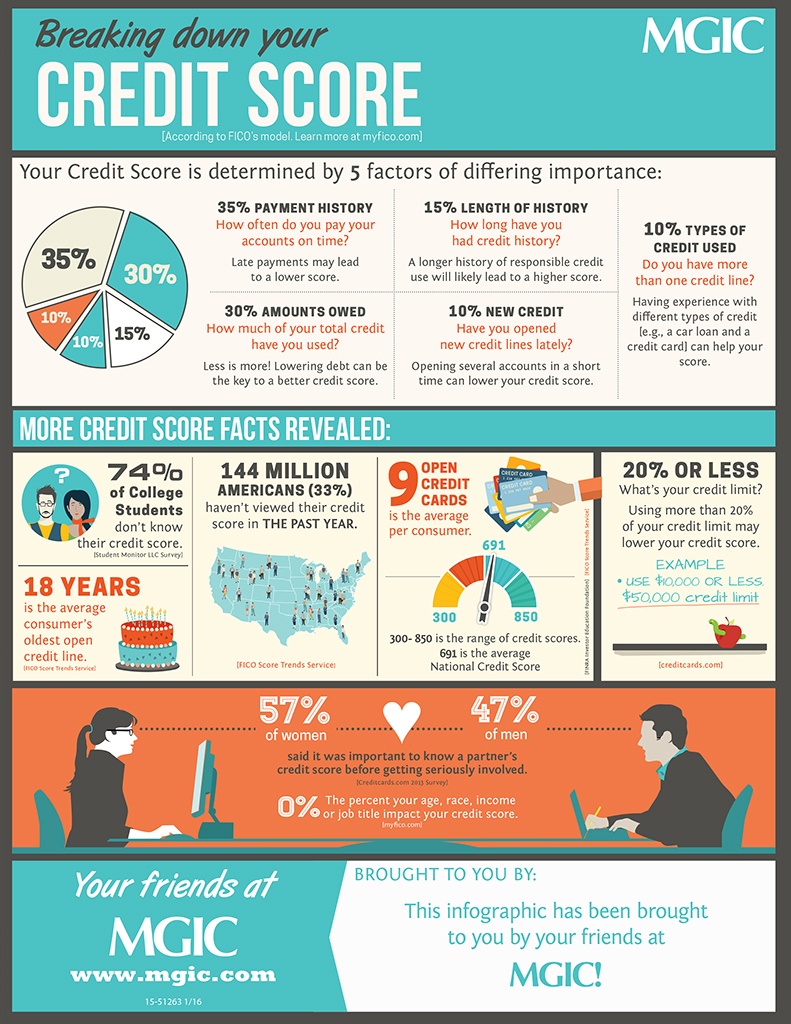

Before applying for a mortgage loan, check your credit score and credit history. Any lender you visit will do this, and by checking on your credit before applying you can see the same information they will see. You can then take the time to clean up any credit problems that might keep you from getting a loan.

Your application can be rejected because of any new changes to your finances. Make sure you have stable employment before applying for a mortgage. Don't change jobs during the mortgage process either, or your lender may decide you are no longer a good risk.

Never sign anything without talking to a lawyer first. The law does not fully protect you from the shrewd practices that many banks are willing to participate in. Having a lawyer on your side could save you thousands of dollars, and possibly your financial future. Be sure to get the right advice before proceeding.

Balloon mortgages are among the easier ones to get approved for. These loans offer a short term with the balance owed at the end of the loan. These loans are risky because you may not be able to obtain financing when the balance comes due.

Try shopping around for a home mortgage. When you do shop around, you need to do more than just compare interest rates. While they're important, you need to consider closing costs, points and the different types of loans. Try getting estimates from a few banks and mortgage brokers before deciding the best combination for your situation.

Save up for the costs of closing. Though you should already be saving for your down payment, you should also save to pay the closing costs. They are the costs associated with the paperwork transactions, and the actual transfer of the home to you. If you do not save, you may find yourself faced with thousands of dollars due.

Pay off your mortgage sooner by scheduling bi-weekly payments instead of monthly payments. You will end up making several extra payments per year and decrease the amount you pay in interest over the life of the loan. This bi-weekly payment can be automatically deducted from your bank account to make it easy and convenient.

Whenever you go to apply for a mortgage it is best to have a good overall financial situation. You have to have some money set aside for closing costs, your down payment, and things like inspections, credit report fees, and everything else you're going to have to pay for. If you have a large down payment, you will have a better mortgage.

Put as much as you can toward a down payment. Twenty percent is a typical down payment, but put down more if possible. Why? The more you can pay now, the less you'll owe your lender and the lower your interest rate on the remaining debt will be. It can save you thousands of dollars.

A fifteen or twenty year loan is worth investigating if you can manage the payments. With the shorter loan term you get reduced interest rates that allow you to pay it down much quicker. This can save you thousands over the term of your mortgage.

If you are a first time home owner, get the shortest term fixed mortgage possible. The rates are typically lower for 10 and 15 year mortgages, and you will build equity in your home sooner. If you need to sell you home and purchase a larger one, you will have more cash to work with.

Pick your price range prior to applying to a broker. If it should be that a lender gives you more money than you can pay back monthly, you'll have some extra room. Do not overextend yourself no matter what. If you do this there may be financial issues later.

One item of documentation for home mortgage application that is often overlooked is a gift letter. If your relatives have chipped in to help you make your down payment, you may need to document your source of income. visit the following post depends on the type of home mortgage you get. Some require this, and others do not. Play it safe by getting a gift letter from anyone who gives you money to help you buy your home. Have this on file with your other documentation.

When you have a question, ask your mortgage broker. You need to know what's going on. Your broker needs to have all of your contact information. Keep looking at your e-mails to see if your broker has asked for certain documents or has some information for you.

Now that you know what it takes to get a mortgage which fits your needs, you have to get down to work and do it. Follow the steps laid out here and begin your planning process. Soon enough, you'll find a great lender who is offering a great rate and your job will be done.